tax preparation fees 2020 deduction

Depending on the complexity of your business tax preparation fees can range from 400 to 4000 and beyond. However the law is only valid from 2018 to 2025.

What Is The Best Tax Software 2022 Winners

Deducting Tax Preparation Fees on Personal Taxes.

. Additionally if you have business income the canada revenue agency also allows. You should include this deduction on your schedule a. Publication 529 122020 Miscellaneous Deductions.

Your tax prep is free. Get every credit and deduction you deserve. According to a national society of accountants survey in 2020 on.

Tax Preparation Fee Schedule 2020 Rivanna Wood Financial Tax Services from. In recent years the use of hybrid entities and hybrid transactions has been a common part of international tax planning strategies. A new client is an individual.

According to the National Society of Accountants the average fee in 2021 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state. However under newly enacted Sec. However the big question is how do you write off your tax preparation fees.

However you may qualify for a deduction if you work as a contractor or you are self-employed. Tax preparation fees on the return. Self-employed taxpayers can still write off their tax prep fees as a business expense.

Find out more about. Accounting fees and the cost of tax prep software are only tax-deductible in a few. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes.

Publication 529 - Introductory Material. However the law is only valid from 2018 to 2025. In many cases you cannot deduct your tax prep fees.

Congress will need to. Tax preparation fees are no longer deductible. A self-employed taxpayer can seek for tax preparation fees deduction on tax returns for the taxable year in which he pays it.

Tax Preparation Fees 2020 Deduction. If youre an employee and you receive a W-2 in order to prepare your taxes the short answer is that you are no longer able to deduct your. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns.

455 Hoes Lane Piscataway NJ 08854 Phone. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. 2019 2020 Tax Deductions Personal.

For example he can deduct tax preparation. The cost of your. Calculate your tax preparation fee for your personal tax return by using this calculator.

The Tax Cuts and Jobs Act TCJA modified or suspended most of the itemized deductions you may have claimed in the past. Offer valid for tax preparation fees for new clients only. Find a bigger refund somewhere else.

The average tax preparation fees in the southeastern united states were only 137 in 2015 while people who live in the middle atlantic region paid more than 250 for their. Interest Tracing Rules Under Temp. Same as a above but with rental or pass through income sched e.

Generally interest expense on a debt is allocated in the same manner as the debt to which such interest expense relates is allocated. The average fee dropped to 220 if you didn.

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Tax Preparation Checklist Updated For 2021 2022 Blatner Mineo Cpa Pc

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Can You Deduct Your Tax Preparation Fees Cpa News

What Is The Cost Of Tax Preparation Community Tax

Filing Taxes Free Filing Info Deductions And Cryptocurrency In 2019

Free Online Tax Filing E File Tax Prep H R Block

Your Guide To 2020 Federal Tax Brackets And Rates

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Optimization Tax Planning Bogart Wealth

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

Tax Preparation Fees Average Cost How To Price Your Tax Preparation Services Tax Pro Center Intuit

How To Deduct Your Tax Preparer Fees Taking Care Of Business

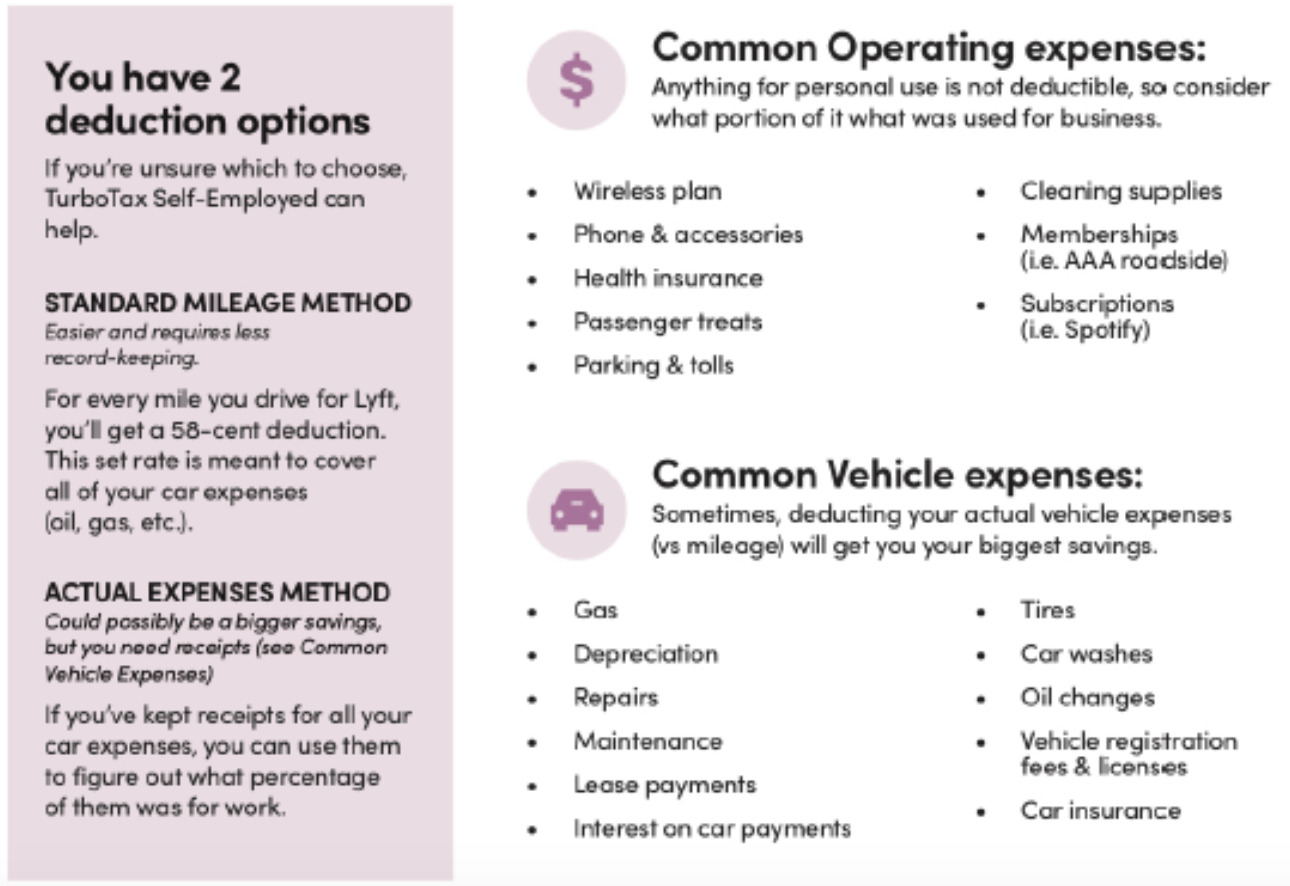

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Tax Rates Standard Deductions Heemer Klein Cpas

Small Business Tax Preparation Checklist How To Prepare For Tax Season